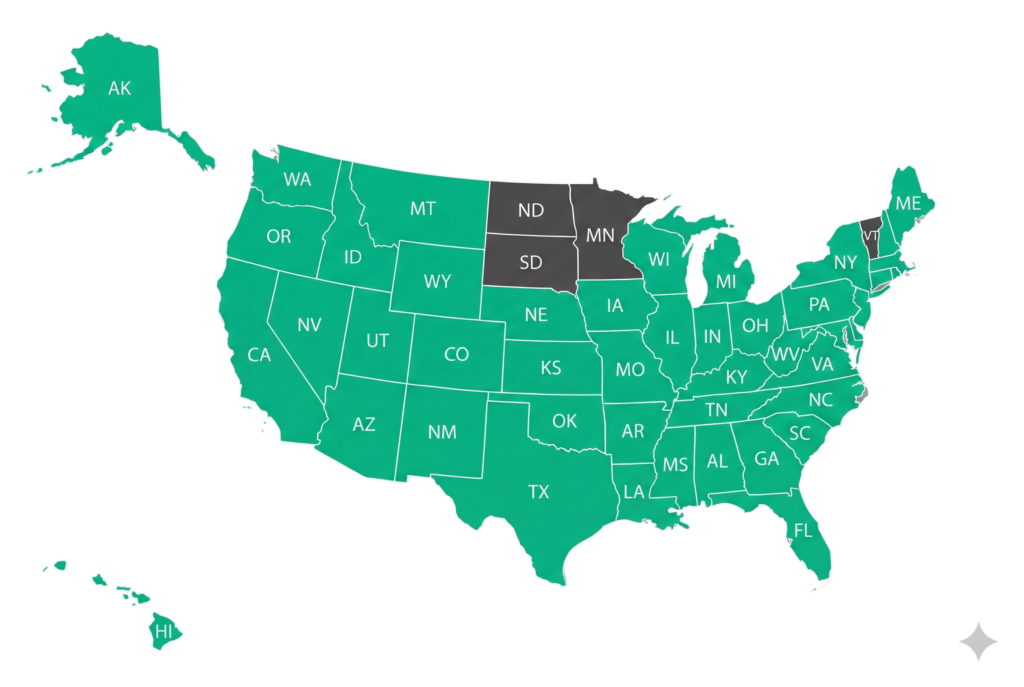

Hard money loans are a type of financing typically secured by real property being purchased for investment, offering quick funds with less stringent credit requirements, often used for investment or renovation projects where speed is crucial. Hard money fund loans fast, typically within 5-10 business days. There are no income or credit requirements and can be used for investment property construction loans.

A hard money loan is a type of short-term loan secured by real estate. These loans are typically used by real estate investors to purchase, renovate, or refinance properties. They are usually provided by private lenders or investor groups and have faster approval processes as compared to traditional loans.

Hard money loans are primarily asset-based, meaning the loan approval is based more on the value of the property rather than the borrower’s creditworthiness. Traditional conventional commercial real estate loans, on the other hand, require extensive credit checks, income verification and other financial documentation. They also take longer to close.

Hard money loans usually have higher interest rates and shorter terms as compared to conventional commercial real estate loans. Common terms include:

Hard money loans are commonly used by real estate investors, house flippers, developers, and those needing quick financing for property acquisition, renovation, or refinancing.

Hard money loans can be used to finance a variety of property types, including:

Qualification criteria typically include:

The application process generally involves:

Yes, hard money loans are often used for properties that require renovation. These loans can be structured to include the costs of the renovations, helping investors to finance both the purchase and improvement of the property. Our hard money program also funds ground up construction on investment and commercial properties in certain markets.

If you cannot repay your hard money loan on time, you may be able to negotiate an extension with the lender. However, if repayment is not possible, the lender has the right to foreclose on the property to recover their investment.

You’ll be assigned to a SimpliLoans expert who will guide you through the process.

Your loan expert will present you with the best available options for your loan.

Lorem ipsum dolor sit amet, cectetur adipiscing elit, seddo.

Lorem ipsum dolor sit amet, cectetur adipiscing elit, seddo.

Lorem ipsum dolor sit amet, cectetur adipiscing elit, seddo.